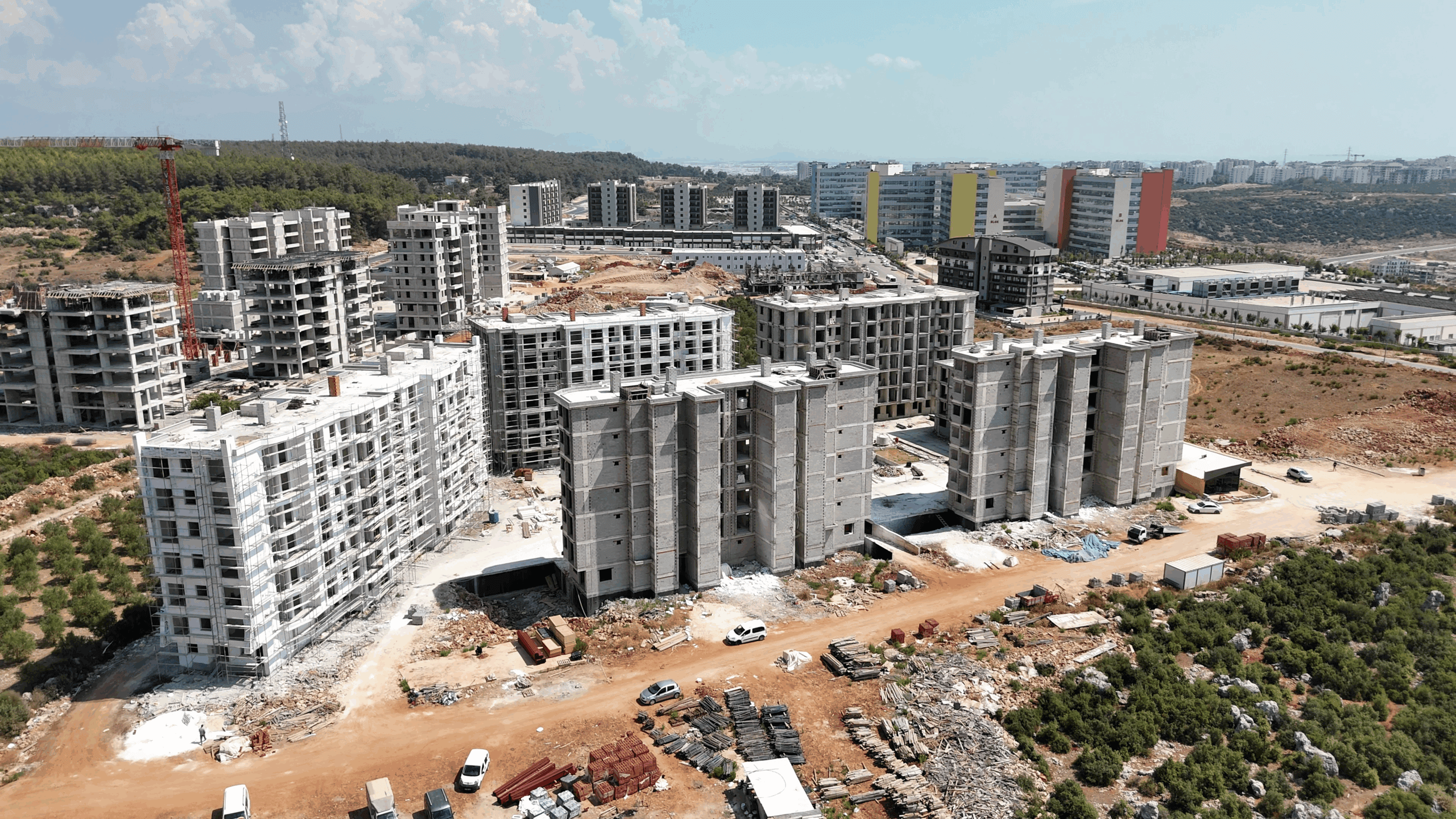

Are you looking for an investment ground where growth isn’t just projected, but actively being built? For high-net-worth individuals, the economic landscape in Turkey right now presents a compelling, concrete opportunity. The story isn’t about potential anymore; it’s about what’s already on the ground.

The most recent data confirms that the Construction boom Turkey is not just a local story—it’s a national economic engine. When you analyze the latest figures, the conclusion is clear: securing your position in Turkish real estate investment 2025 is a strategic move supported by tangible economic momentum.

Turkey Construction Sector Growth: 12.4% Surge in Q3 2025 and What It Means for Your Portfolio

The Turkish economy demonstrated impressive resilience in the third quarter of 2025, posting a 3.8% year-on-year growth, and the construction sector was the undisputed locomotive driving that speed. As reported by the Turkish Statistical Institute (TUIK), the sector expanded by a staggering 12.4% during the quarter. This dwarfs the growth seen in other major contributors like manufacturing (1.2%) and services (3.1%).

What does this mean for your capital?

This isn’t just about putting up new buildings; it signals massive, state-backed investment into infrastructure, urban renewal, and, critically, housing stock. When construction expands this aggressively, it points to strong underlying demand—both domestic and international—and an environment where property values have solid upward pressure.

Decoding the Growth: The Macro Picture

To appreciate your opportunity in Turkish real estate investment 2025, you need to see the bigger picture of Turkey economic growth 2025. The construction surge is fueled by several factors:

- Reconstruction Efforts: Significant resources are being deployed for resilient new housing and infrastructure following recent seismic activity.

- Urban Renewal Projects: Municipalities are pushing forward large-scale modern development plans.

- Foreign Capital Inflow: Investor confidence, often tied to the CBI program, feeds capital directly into tangible assets.

As the official Turkish Investment Office noted, this sector’s performance is “a testament to the nation’s commitment to rebuilding and modernization, creating long-term asset value.” You can review the source directly here: Turkey’s Construction Sector Drives Growth.

Sector Performance vs. The Rest of the Economy

The relative performance of construction against other sectors is what truly catches the sophisticated investor’s eye. While other areas of the economy are stabilizing, construction is accelerating. This divergence creates an asset class—real estate—that is outperforming the general economic narrative.

We can visualize this divergence clearly. The data from TUIK’s official report underlines this point perfectly:

The official data confirms that the Construction boom Turkey is providing a strong foundation for asset appreciation, which is crucial when assessing long-term returns. This robust activity directly translates into asset security for international buyers. You can see the raw bulletin here: TUIK Gross Domestic Product Data.

Portfolio Strategy: Capturing Yields in a High-Growth Environment

Investors targeting Turkish real estate investment 2025 are often seeking dual benefits: strong capital gains from economic expansion and favorable entry points for second-passport programs. Where should you place your capital now?

While Istanbul remains the perennial powerhouse, secondary cities are showing superior short-term yield potential, partly due to the concentrated public and private investment in reconstruction and regional development. This is where an expert eye, like Northpick’s, can spot the value before the broader market catches on.

For those interested in a streamlined acquisition process, you can review our exclusive guide to Turkish property acquisition. We manage the complexities so you can focus purely on the returns.

The Citizenship Connection: Enhanced ROI

The linkage between real estate purchase and Turkey citizenship by investment cannot be overstated. This program provides a clear, defined path to an alternative base of operations or a secondary passport, effectively increasing the utility and value of the underlying asset. The investment acts as both a productive capital allocation and a strategic life asset.

We strongly advise reviewing {the latest on Turkish residency permits} as legislative frameworks can impact program accessibility and processing times.

To illustrate the immediate financial advantage, consider the average yield differentials in key markets benefiting from this construction activity:

| City/Region | Avg. Rental Yield (Est.) | Construction Activity Level | CBI Eligibility Status |

|---|---|---|---|

| Istanbul (New Zones) | 7.5% – 8.5% | High | Eligible |

| Antalya (Coastal) | 8.0% – 9.2% | Very High | Eligible |

| Izmir/Aegean | 6.8% – 7.8% | Medium-High | Eligible |

| Reconstruction Zones | N/A (Capital Growth Focus) | Extreme | Eligible |

Table comparing expected rental yields and construction activity for key regions in Turkish real estate investment 2025.

Next Steps for Your Investment Strategy

You’re looking at a time when macroeconomic stabilization and infrastructure-driven growth are converging. This isn’t the time to hesitate. Your window of opportunity for optimal entry, especially when leveraging the CBI route, requires swift, informed action.

We at Northpick specialize in navigating this precise intersection of economic data and tangible asset acquisition. Don’t let the complexity of Turkey economic growth 2025 obscure the simple truth: the foundations are being laid for significant asset appreciation. We can help you secure your preferred assets efficiently and compliantly. What’s your next move? Are you ready to explore specific property opportunities that fit these high-growth zones?