The Turkey Construction Production Index July 2025 data, recently released by the Turkish Statistical Institute (TÜİK), paints a compelling picture of a sector experiencing robust growth. This significant upswing reflects not just a recovery but a powerful expansion within the Turkish construction sector trends, offering crucial insights for anyone involved in Turkey real estate market analysis or contemplating investment in Turkish construction. Experts at Northpick consistently monitor these vital economic indicators to provide informed perspectives on the nation’s dynamic property landscape. Understanding these trends is paramount for strategic decisions in an evolving market.

Turkey’s construction industry has always been a cornerstone of its economy, directly influencing job creation, infrastructure development, and overall economic stability. After navigating periods of volatility and downturns, the sector demonstrates remarkable resilience and forward momentum as we approach mid-2025. The July figures underscore a period of sustained positive change, signaling a promising outlook for Turkey property development forecast and broader economic health.

Unpacking the Data: Key Trends from the TÜİK Index

The latest Turkey Construction Production Index July 2025 reveals a remarkable period of expansion, particularly when viewed in the context of previous years. A deep dive into the TÜİK data, which measures the unadjusted, calendar-adjusted, and seasonal and calendar-adjusted indices, helps us identify five crucial trends shaping the landscape of Turkish construction.

1. Strong Rebound Post-2022: A Resilient Recovery

Following challenging periods marked by negative annual growth rates, especially evident through 2021 and 2022, the Turkish construction sector has demonstrated a formidable rebound. The year 2024 showed strong positive annual changes across the board, a momentum that has unequivocally carried into 2025. For example, the Total Construction (F) Seasonal and Calendar Adjusted Index saw an impressive annual change of 16.1% in January 2025, climbing to 24.1% by July 2025. This significant recovery highlights the inherent resilience of the sector, attracting renewed interest in investment in Turkish construction.

2. Volatility and Growth: The Journey from 2017 to Mid-2020s

The period from 2017 to the mid-2020s has been characterized by notable fluctuations. While 2018 initially saw a substantial surge in the index, particularly in January (41.7% annual change for total construction), it was followed by a prolonged downturn in subsequent years, exacerbated by global and local economic pressures. However, starting from late 2023, the industry pivoted towards consistent growth, laying the groundwork for the current surge. This historical context is vital for comprehensive Turkey real estate market analysis.

3. Sustained Growth Through Mid-2025: A Positive Outlook

The data for July 2025 solidifies the trend of sustained, vigorous growth. With a Total Construction (F) Seasonal and Calendar Adjusted Index reaching 139.4 and an annual change of 24.1%, the sector is not merely recovering but expanding dynamically. This sustained positive trajectory, with monthly changes also remaining positive (e.g., 1.9% in July 2025), suggests a healthy and expanding market. Such consistent performance bodes well for the overall Turkey property development forecast.

4. Building Construction Leads the Surge: Sectoral Dominance

A closer look at the sub-sectors within construction reveals interesting dynamics. In July 2025, “41-Building construction” reported an annual change of 26.2% in its seasonal and calendar-adjusted index, outpacing “42-Civil engineering,” which recorded a 16.4% annual change. This indicates that the current surge is predominantly driven by building projects—residential, commercial, and industrial structures—underscoring significant opportunities in these areas for investment in Turkish construction.

Turkey: Annual Change in Construction Production Index (Seasonally & Calendar Adjusted, %), January 2023 – July 2025. Data Source: TÜİK.

5. Steady Performance in Specialised Construction Activities

The “43-Specialised construction activities” sub-sector also contributes positively to the overall growth. While its annual change in July 2025 (3.6%) is less dramatic than that of building construction, it reflects a consistent and stable contribution to the industry’s health. This segment, encompassing activities like demolition, site preparation, and installation of specialized building components, provides crucial support for larger projects and signifies a healthy ecosystem within the Turkish construction sector trends.

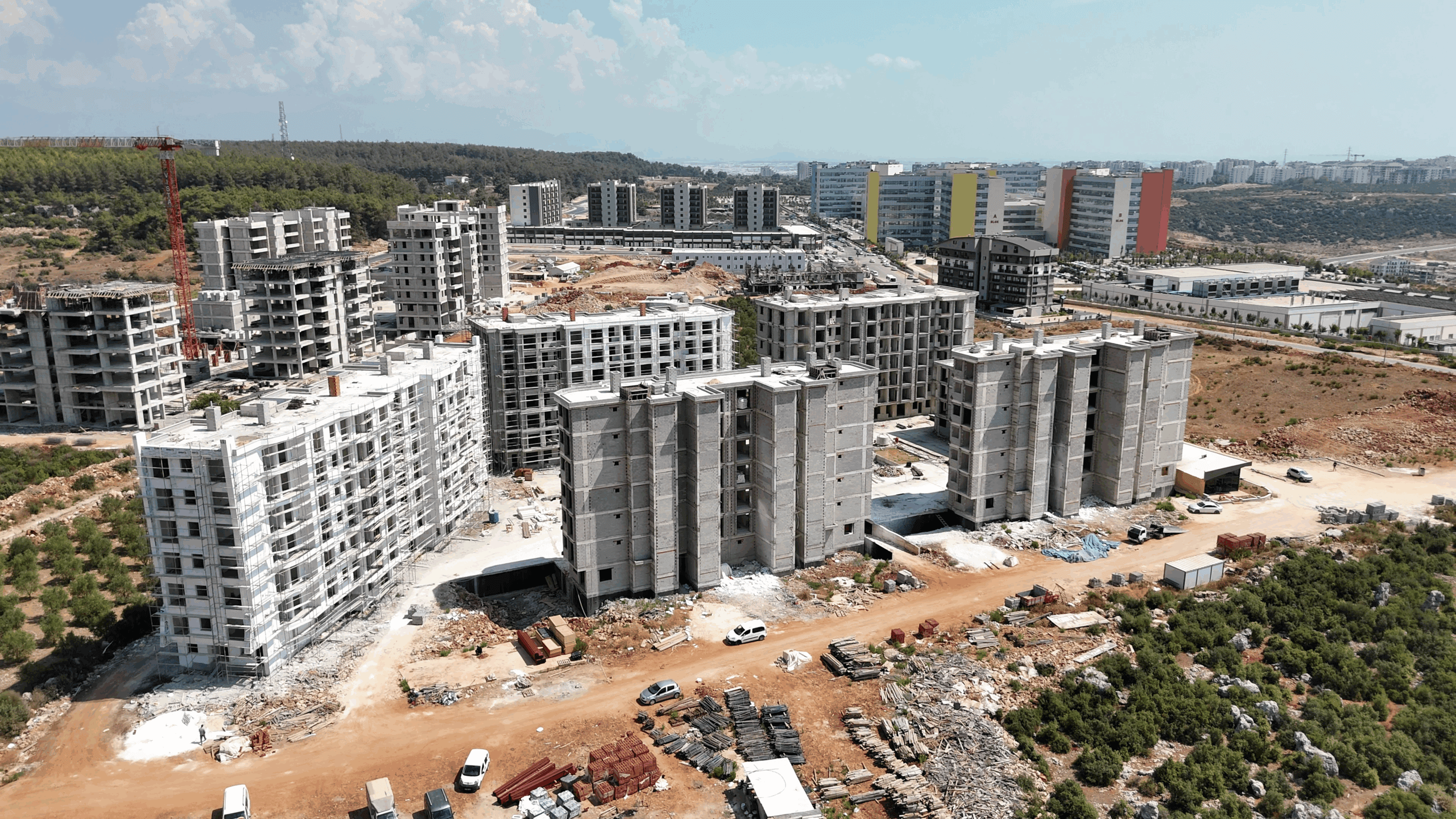

Regional Analysis: Hotspots for Property Development

The robust performance of the construction production index often translates into increased activity in key regions across Turkey. Understanding these regional dynamics is essential for any comprehensive Turkey real estate market analysis and for informing Turkey property development forecast.

- Istanbul: As Turkey’s largest city and economic powerhouse, Istanbul consistently leads in property development. The surge in building construction activity suggests a continued expansion of residential and commercial projects in areas like Başakşehir, Beylikdüzü, and Kartal. The city’s ongoing infrastructure projects also fuel demand for various specialized construction activities. Explore Northpick’s dedicated page for Istanbul properties to discover current investment opportunities.

- Antalya: A prime destination for tourism and foreign investment, Antalya’s construction sector remains vibrant, driven by resort development, luxury residences, and tourism-related infrastructure. The positive construction index indicates continued growth in areas popular with expatriates and holidaymakers.

- Ankara: As the capital city, Ankara benefits from consistent government and institutional investment in infrastructure and public buildings. Its stable demand for housing and commercial spaces makes it a reliable market for property developers.

- Bursa: Known for its industrial strength and natural beauty, Bursa is experiencing steady growth in both residential and industrial construction. Proximity to Istanbul and a growing population contribute to its attractive property market.

- Izmir: A significant port city with a burgeoning economy, Izmir is a hub for both residential and commercial development, particularly in its coastal districts. The positive construction trends suggest a favorable environment for new projects.

Actionable Guidance for Investors

Given the promising outlook indicated by the Turkey Construction Production Index July 2025, here are 3 practical steps for those considering investment in Turkish construction:

Prioritize Sustainable Practices: As environmental consciousness grows, projects integrating sustainable building materials and energy-efficient designs are likely to attract more buyers and offer long-term value. This aligns with global Turkish construction sector trends towards greener development.

Analyze Sub-Sectoral Opportunities: With building construction showing a stronger surge, focus on residential, commercial, and mixed-use development projects. Research specific types of properties experiencing high demand, such as modern apartments in urban centers or villas in coastal regions.

Monitor Regional Hotspots: Direct your investment strategy towards growth areas like Istanbul and Antalya, but also consider emerging cities. Evaluate local development plans and infrastructure projects that could enhance property values.

| Category | Index (2021=100) | Annual Change (%) | Monthly Change (%) |

|---|---|---|---|

| Total Construction (F) | 139.4 | 24.1 | 1.9 |

| 41-Building Construction | 161.3 | 26.2 | 2.6 |

| 42-Civil Engineering | 85.5 | 16.4 | 0.3 |

| 43-Specialised Construction Activities | 129.5 | 3.6 | 0.2 |

Data Source: TÜİK, Index of Production in Construction, July 2025.

A Blueprint for Future Success

The Turkey Construction Production Index July 2025 data unequivocally signals a robust and expanding sector. The significant annual growth rates, particularly in building construction, suggest a healthy environment for development and investment in Turkish construction. This positive trajectory offers a promising Turkey property development forecast, with strong indicators for continued growth through the latter half of 2025 and beyond. As the sector matures, it will be crucial to continue monitoring these Turkish construction sector trends to adapt strategies and capitalize on emerging opportunities. For those looking to make informed decisions in this vibrant market, exploring trusted resources and expert analyses for your next steps is essential. Turkey’s housing data from the Central Bank of the Republic of Turkey offers further insights.