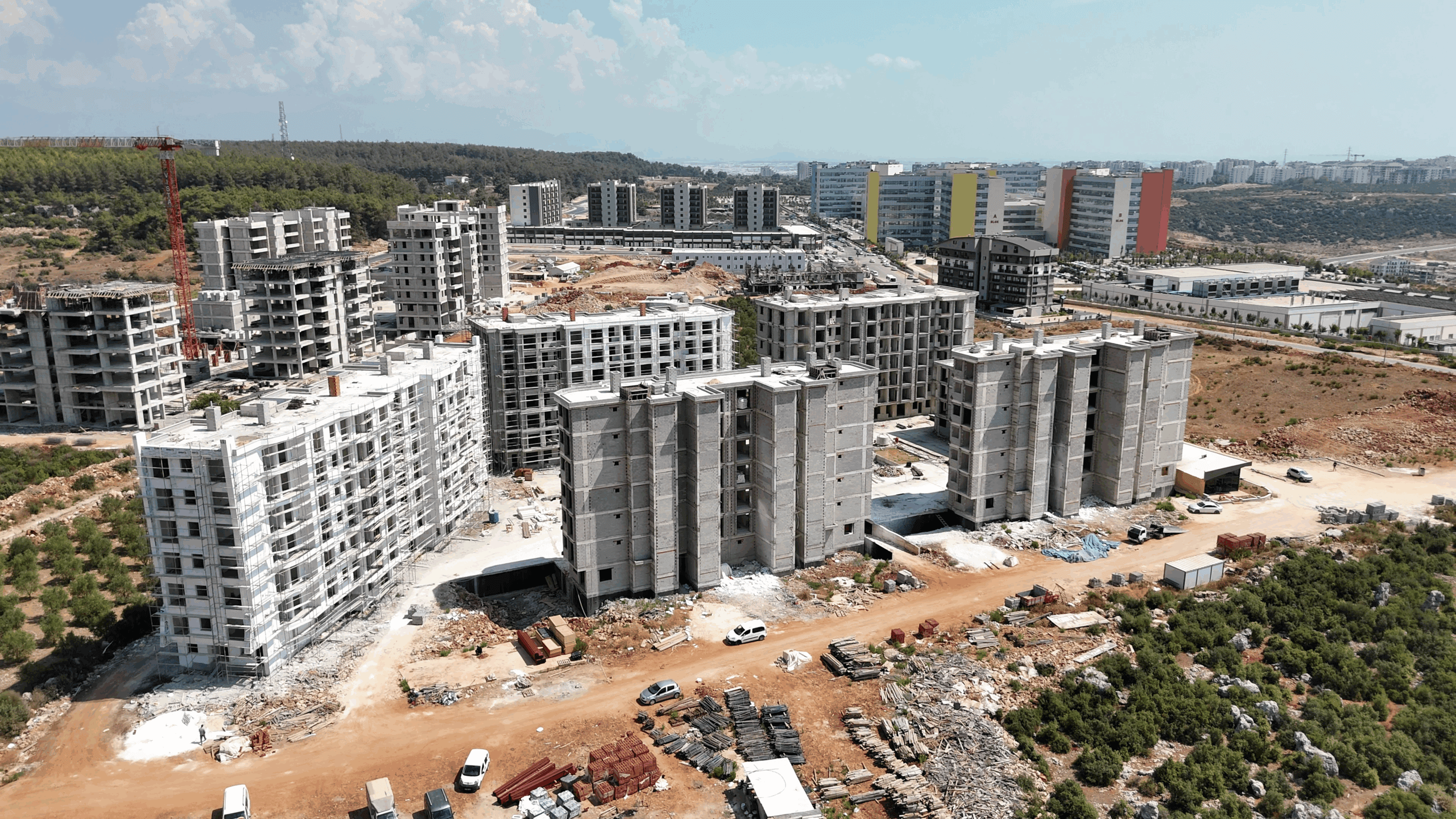

Navigating the dynamic landscape of global markets requires a keen eye on key economic indicators. For those with interests in emerging economies, understanding the heartbeat of sectors like construction is paramount. The latest data from the Turkish Statistical Institute (TUIK) for April 2025 sheds significant light on the Turkey construction industry April 2025 performance, revealing both remarkable annual growth and a slight monthly recalibration. Experts in global real estate markets suggest that these figures are crucial for deciphering broader investment opportunities and potential challenges. This article delves into these insights, providing a data-driven perspective on the sector’s trajectory and its implications for investors and businesses alike.

Insights and Trends in Turkey’s Construction Sector

The Turkey construction industry April 2025 witnessed robust annual growth, with overall production increasing by an impressive 9.5% compared to the same month last year (TUIK, June 17, 2025). This strong year-on-year performance underscores the sector’s resilience and ongoing development. A closer look at the sub-sectors reveals nuanced trends:

- Construction of Buildings: This segment led the charge, experiencing an 11.6% increase annually. This surge indicates continued demand in residential and commercial property development, a key driver in Turkey property investment trends 2025.

- Specialised Construction Activities: Growing by 7.5% year-on-year, this area encompasses a range of activities from demolition to site preparation and installation of utilities, reflecting a vibrant ecosystem supporting broader construction efforts.

- Civil Engineering: Showing a 1.9% annual increase, this vital sub-sector, including infrastructure projects like roads, bridges, and public works, demonstrates steady, albeit more moderate, expansion.

However, the monthly figures present a different picture. Compared to March 2025, the overall production in construction saw a 1.6% decrease. This monthly contraction was reflected across all sub-sectors: building construction fell by 1.9%, civil engineering by 1.1%, and specialized construction activities by 1.0%. While a monthly dip, it is essential to consider this within the context of the strong annual growth, suggesting a potential short-term adjustment rather than a sustained downturn. These intricate movements highlight the complex nature of Turkey property investment trends 2025, where short-term fluctuations can coexist with long-term upward trajectories.

Bar chart for Annual Production Increase in Turkey’s Construction Sub-sectors (April 2025)

Regional and Segment-Specific Analysis

The performance of the Turkey construction industry April 2025 is deeply intertwined with the broader Turkish economy and construction landscape. The significant annual growth in building construction, particularly evident in major urban centers like Istanbul and Antalya, points to continued foreign and domestic investment in real estate. Istanbul, as a global hub, continues to attract substantial property development, contributing to both rental yields and capital appreciation. Similarly, regions like Antalya benefit from tourism-driven construction and the demand for holiday homes, influencing specific property investment trends.

The steady increase in civil engineering projects, though modest, is crucial for the long-term health of the Turkish economy and construction sector. Government initiatives aimed at improving infrastructure, such as new transportation networks or energy projects, create a stable demand for civil engineering services, indirectly supporting the broader construction ecosystem by facilitating access and development. The growth in specialized construction activities further reinforces the idea of a maturing market, where ancillary services are increasingly in demand, from sophisticated building management systems to advanced finishing work. This diversified growth indicates a robust sector that is not solely reliant on new builds but also on maintaining and upgrading existing structures and infrastructure.

| Indicator | Relevance to Construction | Potential Impact |

|---|---|---|

| Inflation Rates | Increases material and labor costs. | Can reduce project profitability and investor confidence. |

| Interest Rates | Affects borrowing costs for developers and homebuyers. | Higher rates can slow down new construction and property sales. |

| Foreign Direct Investment (FDI) | Funds large-scale projects and demand for luxury properties. | Boosts sector growth and introduces new technologies/standards. |

| Government Policies & Incentives | Regulations, urban development plans, and tax breaks. | Can stimulate or hinder growth, affecting specific segments. |

| Currency Stability | Impacts cost of imported materials and investor returns. | Volatility introduces risk; stability encourages long-term investment. |

Table for Key Economic Indicators Impacting Turkey’s Construction Sector

Actionable Guidance for Investors

For those considering engagement with the Turkey construction industry April 2025 or exploring the Turkey property investment trends 2025, several practical steps are advisable. Firstly, conduct thorough due diligence on specific projects and regions. While overall growth is positive, micro-market conditions can vary significantly. Research local regulations before investing in properties, particularly concerning foreign ownership and taxation. To learn more about purchasing property in Turkey, explore Northpick’s comprehensive guide. Secondly, understand the nuances of the Turkish economy; factors like inflation, interest rates, and currency stability can impact investment returns. Thirdly, consider diversifying your investment across different sub-sectors or regions to mitigate risk. Engaging with established local entities or legal professionals who possess deep knowledge of the Turkish market is always recommended. Staying informed on the latest economic data and policy changes is crucial for making confident and well-informed decisions in this dynamic market.

Key Takeaways and Next Steps

The TUIK data for April 2025 paints a picture of a resilient and growing Turkey construction industry April 2025, marked by substantial annual expansion despite a minor monthly adjustment. The strong performance of building construction and specialized activities signals continued opportunities, aligning with positive Turkey property investment trends 2025. This growth is a testament to the ongoing development within the Turkish economy and construction sector. To capitalize on these trends, staying informed about market dynamics and seeking professional guidance are paramount. Explore trusted resources to guide your next steps and ensure your investment decisions are well-grounded in data and expert insights.