The Unexpected Twist in Turkey’s May 2025 Property Market

When May 2025 house sales statistics for Turkey were published by TÜİK, most industry experts anticipated another month of familiar trends: Istanbul leading the market, strong Russian demand, and coastal favorites like Antalya showing resilience. Yet, this month the data revealed an unexpected development—foreigners buying property in Turkey May 2025 dropped to the lowest level since 2022, even as domestic demand stayed robust and economic incentives remained.

Market insight teams at Northpick flagged this dip quickly, illustrating how closely monitoring small changes can reveal bigger shifts in Turkey’s real estate trajectory.

Sales to Foreigners Drop Sharply: The Main Surprise

The headline statistic:

Only 2,100 residential properties were sold to foreigners in May 2025—a 34.7% decline year-on-year. This amounted to just 1.9% of all transactions, the lowest share since early 2022.

Key breakdown by nationality (source: TÜİK):

- House sales to Russians in Turkey: 510 units (down 27% vs. May 2024)

- Sales to Iranians: 220 units (down 40% vs. prior year)

- Sales to Ukrainians: 117 units (down 17%)

- Next largest groups: Germans (93), Kazakhs (85)

This downturn surprised many, given ongoing headlines about surging foreign interest.

House Sales to Foreigners by Nationality, May 2025

A New Era for Russian Buyers and Market Shifts

For the past three years, Russians have consistently led the Turkish property market among foreigners. In May 2025, this dominance continued—yet with a notable drop in total sales. The shrinking gap between Russian and other foreign buyers (like Iranians and Ukrainians) suggests mounting caution among all major groups.

This shift is linked to:

- Stricter financial and residency rules affecting foreign buyers

- Increased regulatory scrutiny from Turkish banks, notaries, and government

- Economic volatility in buyers’ home countries and shifting currency situations

These changes may mark a new chapter in the foreign segment of Turkey’s real estate market.

Top Provinces for Foreign House Sales, May 2025

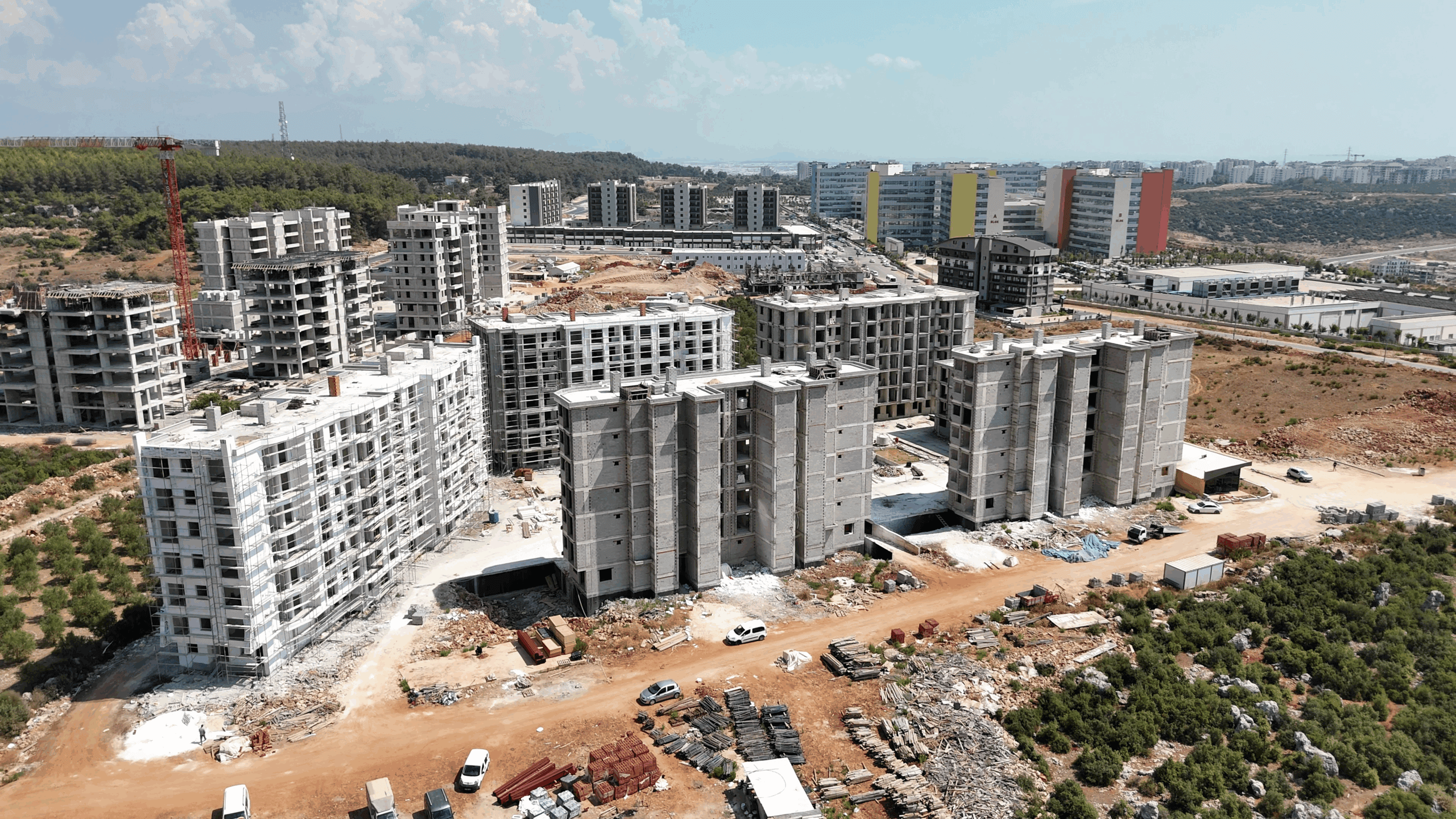

Regional Hotspots: Antalya, Istanbul, and Mersin

Antalya remains the number one choice among foreign buyers, recording 805 foreign house sales, followed by Istanbul with 668 and Mersin with 210. Both resort-driven demand and urban lifestyle continue to attract attention, but even top cities saw year-on-year declines.

In Istanbul, key districts such as Başakşehir, Kadıköy, and Beylikdüzü pulled the highest foreign demand—predominantly for new builds, which made up over 60% of all such transactions. Notably, women now represent 33% of foreign buyers, a proportion that climbs higher within metropolitan markets.

For those considering market entry, our guide to Antalya investment opportunities offers neighborhood-level perspective and up-to-date price trends.

House Sales to Foreigners by Nationality: May 2024 vs May 2025, Turkey

A Stabilizing Domestic Market and the May 2025 House Price Report

Amid fading foreign demand, the Turkey house price report May 2025 highlights persistent stability on the domestic front. Across Turkey, average sale prices continued their climb, with annual growth reported at 8.4%—slower than the previous year’s pace but still robust, especially in urban hotspots.

Domestic buyers, fueled by internal migration and long-term investment confidence, are keeping transaction numbers high in core regions. This resilience ensures the Turkish housing sector remains healthy, despite short-term dips in international transactions.

For a thorough legal and procedural roadmap, see our Guide to Turkish property law.

What Does This Mean for Buyers and Investors?

May 2025’s contraction in foreign purchases signals the end of an “automatic growth” phase for global investors in Turkey. However, new opportunities are emerging:

- Sellers in high-competition areas (especially Antalya and Istanbul) are more open to negotiation.

- New builds and long-term rental properties are increasingly favored by buyers seeking value and resilience.

- A data-driven approach is crucial—especially given dynamic regulation and shifting demand.

As always, we recommend referencing official sources like the Invest in Turkey: Official Investment Guide for evolving regulatory updates, and following Northpick insights for expert local analysis.

Key Takeaways

- Foreigners buying property in Turkey May 2025 reached a three-year low, despite stable domestic demand.

- Russians are still the largest group, but all major nationalities saw double-digit decreases.

- Leading provinces—Antalya, Istanbul, and Mersin—retained their rank but not their momentum.

- New legal and financial rules are tightening the international segment, while locals keep demand strong.

- Smart, patient investment and area-specific research now matter more than ever.